Sustainability

Sustainability

Promoting Sustainability

Views on Sustainability

The OPEN HOUSE Group promotes sustainability aiming to contribute to the realization of a sustainable society through our business activities while achieving sustainable corporate growth.

As stated in our corporate philosophy, the Group has been pursuing houses that customers want honestly and constantly, while working on our business with the mission of “leaving a Japan for the next generation where working people can afford houses in urban areas.”

By providing affordable housing in urban areas, we aim to fulfill needs for both social and business value by creating shared value.

In addition, the Group is keenly aware of the social responsibility associated with our business activities and our contributions toward achieving SDGs, and we are promoting initiatives through our business activities for issues related to ESG (environment, social and governance).

For more information:

OPEN HOUSE Group’s Corporate Philosophy & Corporate PrinciplesPromotion Organization

The Group has established the Sustainability Committee, which operates under the oversight of the Board of Directors, manages the progress of our response to ESG risks by materiality item and collects information on initiatives from individual operating divisions and Group companies.

The progress and results are reported to the Sustainability Committee and important subjects discussed at this committee are regularly reported to the Board of Directors.

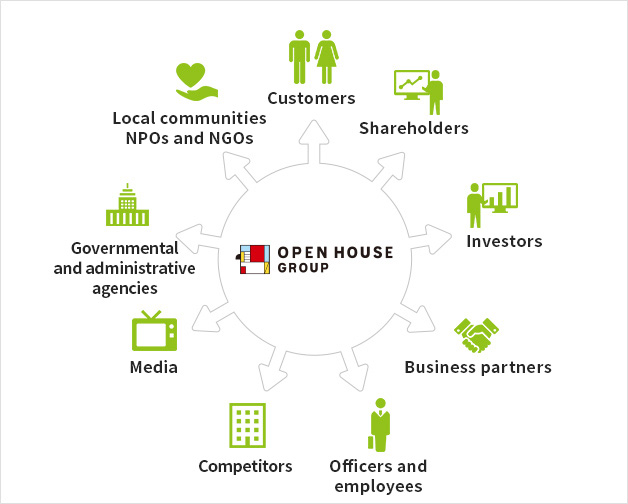

Relationship with Stakeholders

Our business is made possible through the involvement of a wide range of stakeholders including our customers, shareholders, local communities, governmental and administrative agencies, business partners, and officers and employees. Because our business activities centered on home building involve many stakeholders, we believe that building a relationship of trust with those stakeholders is important in promoting sustainability.

Our relationship with the customers who live in the homes we sold and with stakeholders in the local communities is particularly strong in terms of building a sustainable society together. Creating opportunities for dialogue and reflecting that dialogue in our business activities is essential in realizing our goal for creating shared value (CSV) of “providing the houses that customers want.”

Furthermore, “Appropriate Cooperation with Stakeholders Other Than Shareholders” and “Dialogue with Shareholders” are parts of the basic principles of the Tokyo Stock Exchange’s “Corporate Governance Code.” As such, we hold dialogue in various formats with stakeholders and promote multiple initiatives to reflect those opinions in our management.

| Stakeholders | Main opportunities for dialogue | Relevant themes |

|---|---|---|

| Customers | ・Conducting the NPS questionnaire* ・Establishing the Customer Service Office ・Communication through sales activities | ・OPEN HOUSE Group’s CSV goal of “providing the houses that customers want” ・Initiatives to promote customer satisfaction |

| Communities and society | ・Cooperation with administrative agencies, local governments, and NPOs ・Social contribution activities | ・Products That Contribute to Solving Social Issues ・Social Contributions ・Regional Co-creation Projects |

| Employees | ・Communication through human resource evaluations ・Dialogue through compliance questionnaires, etc. | ・Talent Development ・Work-Style Reforms and Promoting Diversity ・Health and Safety |

| Business partners | ・Communication through operations ・Communication through procurement ・Holding various workshops ・Distributing sustainability guidelines to our business partners | ・Health and Safety ・Supply Chain Management |

| Shareholders and investors | ・Consolidated financial results briefings ・Meetings with institutional investors ・Communication using IR-related tools | ・Engagement ・Shareholder returns ・Enhancing corporate value |

* NPS is an abbreviation for “Net Promoter Score.” This is one indicator to measure “customer loyalty,” the level of customer affinity for companies, products, or services.

External Evaluation

FTSE4Good Index Series

FTSE Russell (the trading name of FTSE International Limited and Frank Russell Company) confirms that Open House Group Co., Ltd. has been independently assessed according to the FTSE4Good criteria, and has satisfied the requirements to become a constituent of the FTSE4Good Index Series.

Created by the global index provider FTSE Russell, the FTSE4Good Index Series is designed to measure the performance of companies demonstrating strong Environmental, Social and Governance (ESG) practices.

The FTSE4Good indices are used by a wide variety of market participants to create and assess responsible investment funds and other products.

For more information:

FTSE4Good Index SeriesFTSE JPX Blossom Japan Index

FTSE Russell confirms that Open House Group Co., Ltd. has been independently assessed according to the index criteria, and has satisfied the requirements to become a constituent of the FTSE JPX Blossom Japan Index.

Created by the global index and data provider FTSE Russell, the FTSE JPX Blossom Japan Index is designed to measure the performance of companies demonstrating specific Environmental, Social and Governance (ESG) practices.

The FTSE JPX Blossom Japan Index is used by a wide variety of market participants to create and assess responsible investment funds and other products.

For more information:

FTSE Blossom Japan Index SeriesFTSE JPX Blossom Japan Sector Relative Index

FTSE Russell confirms that Open House Group Co., Ltd. has been independently assessed according to the index criteria, and has satisfied the requirements to become a constituent of the FTSE JPX Blossom Japan Sector Relative Index.

The FTSE JPX Blossom Japan Sector Relative Index is used by a wide variety of market participants to create and assess responsible investment funds and other products.

For more information:

FTSE Blossom Japan Index SeriesMSCI Japan ESG Select Leaders Index

The MSCI Japan ESG Select Leaders Index is composed by selecting companies with relatively high ESG ratings within each industry from the constituents of the MSCI Japan Investable Market Index (Parent Index).

MSCI Nihonkabu ESG Select Leaders Index

The MSCI Nihonkabu ESG Select Leaders Index is composed by selecting companies with relatively high ESG ratings within each industry from the constituents of the MSCI Nihonkabu Investable Market Index (Parent Index).

MSCI Japan Empowering Women Index (WIN)

The MSCI Japan Empowering Women Index (WIN) is an ESG index developed by MSCI, which selects companies excelling in gender diversity. The index is also adopted by the Government Pension Investment Fund (GPIF).

THE INCLUSION OF OPEN HOUSE GROUP CO., LTD. IN ANY MSCI INDEX, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT OR PROMOTION OF OPEN HOUSE GROUP CO., LTD. BY MSCI OR ANY OF ITS AFFILIATES. THE MSCI INDEXES ARE THE EXCLUSIVE PROPERTY OF MSCI. MSCI AND THE MSCI INDEX NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI OR ITS AFFILIATES.

S&P/JPX Carbon Efficient Index

A universe of TOPIX, which is a typical stock index that shows trends in the Japanese market. The index determines the weights of the constituent stocks by focusing on the status of disclosing environmental information and the level of carbon-efficiency (carbon emissions per sales).

By adopting rules such as raising the weights of companies that adequately disclose environmental information and companies with high carbon efficiency (with low carbon emissions per sales), we are aiming to stimulate the stock market by encouraging environmental initiatives and information disclosure throughout the market.

Sustainable Finance

Positive Impact Finance

Mizuho Bank., Ltd.

We entered into a contract with Mizuho Bank., Ltd. to execute borrowing under the "Mizuho Positive Impact Finance (a type of financing for corporate borrowers that does not specify the use of funds)" in accordance with the Positive Impact Finance Principles*1 advocated by the United Nations Environment Programme Finance Initiative (UNEP FI)*2.

Outline of borrowings

Loan Amount

10 billion yen

Lender

Mizuho Bank., Ltd.

Loan Term

10 years

Use of funds

Business funds

Execution date

28 February, 2022

Loan Amount

10 billion yen

Lender

Mizuho Bank., Ltd.

Loan Term

10 years

Use of funds

Business funds

Execution date

22 September, 2023

Loan Amount

10 billion yen

Lender

Mizuho Bank., Ltd.

Loan Term

7 years

Use of funds

Business funds

Execution date

27 December, 2024

Loan Amount

5 billion yen

Lender

Mizuho Bank., Ltd.

Loan Term

7 years

Use of funds

Business funds

Execution date

31 March, 2025

Resona Bank, Limited

In March 2023, we executed a "Positive Impact Loan (a type of financing for corporate borrowers that does not specify the use of funds)" with Resona Bank, Limited, in accordance with the Positive Impact Finance Principles*1 advocated by the United Nations Environment Programme Finance Initiative (UNEP FI)*2.

Outline of borrowings

Loan Amount

5 billion yen

Lender

Resona Bank, Limited

Loan Term

10 years

Use of funds

Long-term business funds

Execution date

20 March, 2023

*1A common financial framework for achieving the SDGs, announced in 2017 by the Positive Impact Working Group, a member of UNEP FI's banks and investors. It provides a comprehensive assessment of the impact, both positive and negative, on the three aspects of sustainable development (environment, society, economy). In addition, UNEP FI presents the Impact Radar, a tool for identifying impacts, consisting of 22 categories including climate, water, energy, biodiversity, culture, and tradition.

*2 A partnership between the UNEP FI and the global financial sector, established in the wake of the 1992 Earth Summit to promote sustainable finance.

Sumitomo Mitsui Banking Corporation

Loan Amount

10 billion yen

Loan Term

10 years

Use of funds

Business capital

Execution date

10 October, 2024

Syndicated Loans

Sumitomo Mitsui Banking Corporation

In September 2022, we raised funds through syndicated loans totaling 20.5 billion yen based on "ESG/SDGs Assessment" in "ESG/SDGs Assessment Syndication" provided by Sumitomo Mitsui Banking Corporation.

This loan is a syndicated loan originated by financial institutions that evaluated the efforts of companies in terms of ESG, disclosures, and contributions to the achievement of SDGs based on their own assessment standards prepared by the Sumitomo Mitsui Banking Corporation and the Japan Research Institute, Limited, and agreed to the purpose of the loan.

Outline of borrowings

Loan Amount

20.5 billion yen

Arranger

Sumitomo Mitsui Banking Corporation

Participating financial institutions

Sumitomo Mitsui Banking Corporation

Mizuho Bank., Ltd.

The Yamanashi Chuo Bank., Ltd.

The Ashikaga Bank., Ltd.

Kiraboshi Bank., Ltd.

San ju San Bank., Ltd.

The Chiba Kogyo Bank., Ltd.

The Hokuriku Bank., Ltd.

The Minato Bank., Ltd.Loan Term

28 September, 2022 to 28 September, 2032

Use of funds

Business funds

Execution date

28 September, 2022

The Gunma Bank., Ltd.

Loan Amount

5 billion yen

Arranger

The Gunma Bank., Ltd.

Participating financial institutions

The Gunma Bank., Ltd.

Daishi Hokuetsu Bank., Ltd.

The Toho Bank., Ltd.

The Musashino Bank., Ltd.Loan Term

7 years

Use of funds

Business funds

Execution date

30 September, 2024

ESG Information Disclosure

Information on the Group’s initiatives for ESGs is disclosed on this website in a timely and appropriate manner. When disclosing information, system refer to external guidelines such as GRI (Global Reporting Initiative) and ISO26000, SDGs, and also incorporate the views of external stakeholders and experts in order to ensure transparency of corporate management/reporting and to respond appropriately to social demands.

Furthermore, we have prepared the ESG Information Index for ESG investors and ESG rating organizations. The Group discloses comprehensive information corresponding to ESG ratings from MSCI, FTSE and other organizations.

Comprehensive list of the Group’s ESG information

Sustainability

Materialities

Promoting Sustainability

Environmental Conservation

Providing and Ensuring Product

Safety and Security, and Promoting

Customer SatisfactionProducts That Contribute to Solving

Social IssuesTalent Development and Labor

PracticesWork-Style Reforms and Promoting

DiversityHealth and Safety

Respecting Human Rights

Supply Chain Management

Regional co-creation Project

Social Contributions

Compliance

ESG Information Index